How to Get a Quick Loan on Airtel

Last Updated on August 21, 2024 by Micheal W S

This post talks about how to get a quick loan on Airtel. In Uganda, quick loans are becoming more popular, especially now that people are recovering from the pandemic and need cash fast. Airtel Uganda teamed up with a fintech startup called YABX to introduce a service called Airtel Quick Loans. This service is designed to help people get through tough financial times by giving them quick access to money when they need it most.

What is Airtel Quick Loan?

Airtel Quick Loans is a service offered by Airtel Uganda that lets you borrow money to complete transactions when you don’t have enough funds in your Airtel Money account.

Whether you’re sending money, making payments, or buying airtime and bundles, Airtel Quick Loans can help you finish your transaction even when your balance is low. If you’re wondering how to get a quick loan on Airtel, this service makes it simple.

ALSO READ: Airtel Money Charges

Eligibility and How to Sign Up

Not everyone can get an Airtel Quick Loan, but if you’re eligible, signing up is easy. You must have used Airtel Money for six months with at least one transaction each month and cleared any previous Airtel Money loans.

How to get a quick loan on Airtel starts with:

- Dialing *185*8*2# on your phone

- Entering your Airtel Money PIN

After you sign up, Airtel Uganda will check if your number qualifies for the loan service. If you’re eligible, you’ll get a welcome message and can start using the service right away.

If not, keep using Airtel Money as usual and check back later to see if you qualify.

How to Use Airtel Quick Loan

After signing up for Quick Loan, you can start using it by following these steps:

- Dial *185# and attempt a transaction, such as sending money or paying a bill.

- It doesn’t matter how much money is currently in your account.

- The amount you can borrow with Quick Loan can be higher.Try sending an amount that is more than your current balance.

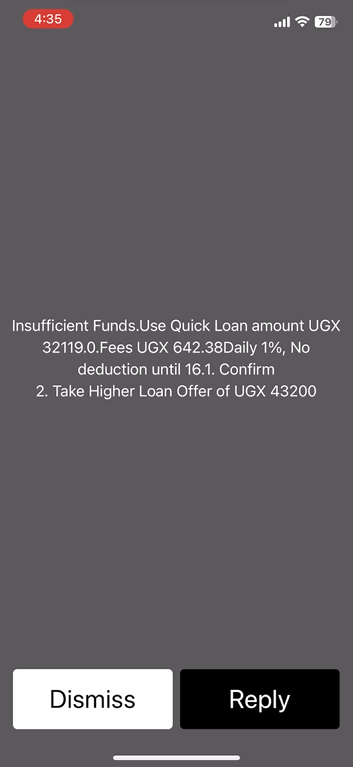

- For example, if you’re sending money to someone, enter an amount higher than what’s available in your account.The transaction will fail, and you’ll receive a prompt.

- A message will appear, offering to complete the transaction using Quick Loan.Dial the code provided in the message to borrow the amount needed.

- The loan will be credited to your mobile money account.After the loan is credited, you can check your balance, which will now include the loaned amount.

- Finally, retry the transaction, and it will be successful as long as the transaction amount matches your updated balance.

How to Repay Airtel Quick Loan

Repaying your Airtel Quick Loan is simple and straightforward. Whether you want to pay off the entire amount at once or make partial payments, Airtel Uganda has made the process easy to follow.

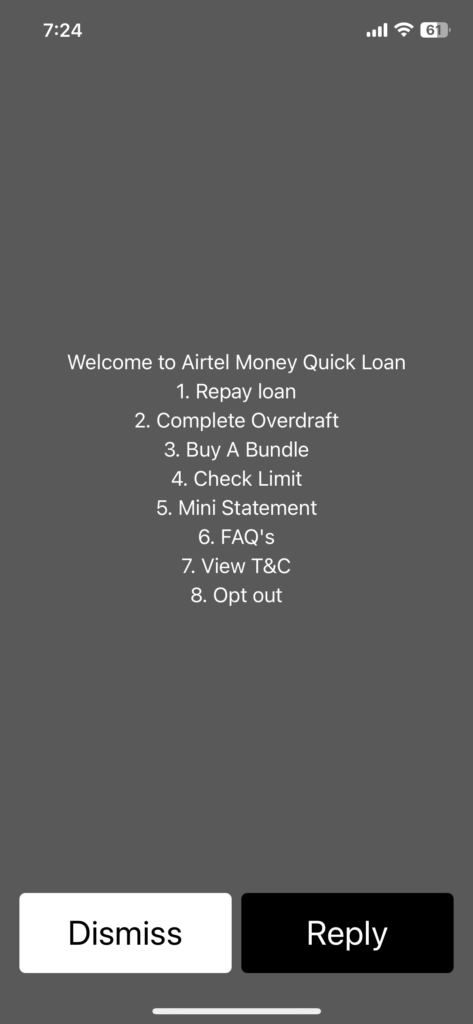

- Dial *185*8*2#

- Enter your Airtel Money Pin

- Select Option 1: Repay Loan

- Select either to pay partially or the full amount

- The amount will be deducted from your Mobile Money balance and you will receive a message saying the amount has been deducted with your updated balance.

Features and Benefits of Airtel Quick Loans

Airtel Quick Loans comes with some handy features. For example, you can take multiple loans as long as you stay within your credit limit. You can use this service to send money, pay merchants, cover bills, or buy data bundles and airtime.

The loan gives you flexibility, so you don’t have to worry about your account balance when you need to make an urgent payment. Quick loan Uganda services like this are becoming essential for many people.

Using Airtel Quick Loans

Using Airtel Quick Loans is straightforward. If you’re trying to send money but don’t have enough in your Airtel Money account, how to get quick loan on Airtel Money is simple.

Just dial *185# to start the transaction. If your balance is too low, the Airtel Quick Loan menu will pop up to let you borrow the money needed to complete the transaction.

This same process works for buying airtime, paying bills, and other transactions. It’s a quick and easy solution for how to get a quick loan in Uganda.

Fees, Charges, and Repayment Terms

Airtel Quick Loans come with some costs. There’s a 2% application fee, and they charge 1% interest on the amount you borrow every day for up to 15 days. For example, if you borrow 50,000 UGX, you’ll end up paying back 58,500 UGX if you take the full 15 days to repay.

However, if you pay back sooner, the interest will be lower, saving you money. Understanding the fees is an important part of how to get a quick loan on Airtel responsibly.

Managing Your Airtel Quick Loan

You can easily check your loan limit and manage your loan using the Airtel Quick Loan menu. How to get quick loan on Airtel Money and manage it is as easy as dialing *185*8*2# to access the menu.

To see how much you can borrow, select the option to check your limit. When it’s time to repay, choose the repayment option, enter the amount you want to pay, and follow the prompts.

You can also make partial payments if you don’t have the full amount. This feature makes quick loan Uganda services convenient and user-friendly.

Limits and Restrictions

Airtel Quick Loans have some limits to keep in mind.

- There are minimum and maximum amounts you can borrow, and the loan is mainly for completing specific transactions like sending money or paying bills.

- You can’t withdraw the loan as cash, and you need some balance in your Airtel Money account to access the loan.

Knowing how to get a quick loan on Airtel and understanding these limits will help you use the service effectively.

Conclusion

Airtel Quick Loans is a helpful service for anyone who needs a little extra money to get through a financial pinch. It’s easy to use, has flexible terms, and can be a real lifesaver when your balance is low.

If you think this service could be useful, check if you’re eligible and sign up today to see how to get quick loan on Airtel and start benefiting from this quick loan Uganda service.