Bii o ṣe le Gba awin Iyara lori Airtel

Imudojuiwọn to kẹhin ni Oṣu Kẹjọ Ọjọ 21, Ọdun 2024 nipasẹ Michael WS

Ifiweranṣẹ yii sọrọ nipa bii o ṣe le gba awin iyara lori Airtel. Ni Ilu Uganda, awọn awin iyara ti di olokiki diẹ sii, ni pataki ni bayi pe eniyan n bọlọwọ lati ajakaye-arun ati nilo owo ni iyara. Airtel Uganda darapọ pẹlu ibẹrẹ fintech kan ti a pe ni YABX lati ṣafihan iṣẹ kan ti a pe ni Awọn awin Iyara Airtel. Iṣẹ yii jẹ apẹrẹ lati ṣe iranlọwọ fun eniyan lati gba awọn akoko inawo lile nipa fifun wọn ni iwọle ni iyara si owo nigbati wọn nilo pupọ julọ.

Kini Awin Iyara Airtel?

Airtel Quick Loans is a service offered by Airtel Uganda that lets you borrow money to complete transactions when you don’t have enough funds in your Airtel Money account.

Boya o nfi owo ranṣẹ, ṣiṣe awọn sisanwo, tabi rira akoko afẹfẹ ati awọn edidi, Awọn awin Iyara Airtel le ṣe iranlọwọ fun ọ lati pari idunadura rẹ paapaa nigbati iwọntunwọnsi rẹ ba lọ silẹ. Ti o ba n iyalẹnu bi o ṣe le gba awin iyara lori Airtel, iṣẹ yii jẹ ki o rọrun.

KA tun: Owo Airtel

Yiyẹ ni ati Bi o ṣe le forukọsilẹ

Kii ṣe gbogbo eniyan le gba awin Iyara Airtel, ṣugbọn ti o ba yẹ, iforukọsilẹ jẹ irọrun. O gbọdọ ni lo Airtel Owo fun osu mefa pẹlu o kere ju idunadura kan ni oṣu kan ati imukuro eyikeyi awọn awin Owo Airtel tẹlẹ.

How to get a quick loan on Airtel starts with:

- Pipe *185*8*2# on your phone

- Titẹ PIN Owo Owo Airtel rẹ sii

After you sign up, Airtel Uganda will check if your number qualifies for the loan service. If you’re eligible, you’ll get a welcome message and can start using the service right away.

Ti kii ba ṣe bẹ, tẹsiwaju lilo Owo Airtel bi igbagbogbo ati ṣayẹwo nigbamii lati rii boya o yẹ.

Bii o ṣe le Lo Awin Iyara Airtel

Lẹhin wíwọlé soke fun Awin kiakia, o le bẹrẹ lilo rẹ nipa titẹle awọn igbesẹ wọnyi:

- Tẹ * 185 # ki o gbiyanju idunadura kan, gẹgẹbi fifiranṣẹ owo tabi san owo kan.

- It doesn’t matter how much money is currently in your account.

- The amount you can borrow with Quick Loan can be higher.Try sending an amount that is more than your current balance.

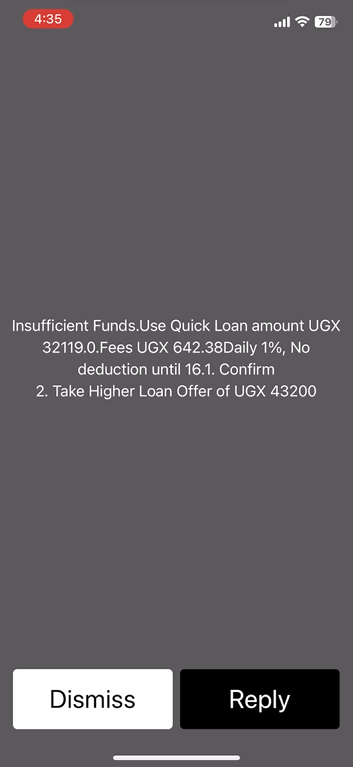

- For example, if you’re sending money to someone, enter an amount higher than what’s available in your account.The transaction will fail, and you’ll receive a prompt.

- A message will appear, offering to complete the transaction using Quick Loan.Dial the code provided in the message to borrow the amount needed.

- Awọn kọni yoo wa ni ka si rẹ mobile owo iroyin.Lẹhin ti awọn kọni ti wa ni ka, o le ṣayẹwo rẹ iwontunwonsi, eyi ti yoo bayi ni awọn loaned iye.

- Nikẹhin, tun idunadura naa gbiyanju, ati pe yoo jẹ aṣeyọri niwọn igba ti iye idunadura naa baamu iwọntunwọnsi imudojuiwọn rẹ.

Bii o ṣe le san awin iyara Airtel san pada

Awin Quick Awin Airtel rẹ jẹ rọrun ati taara. Boya o fẹ lati san gbogbo iye ni ẹẹkan tabi ṣe awọn sisanwo apakan, Airtel Uganda ti jẹ ki ilana naa rọrun lati tẹle.

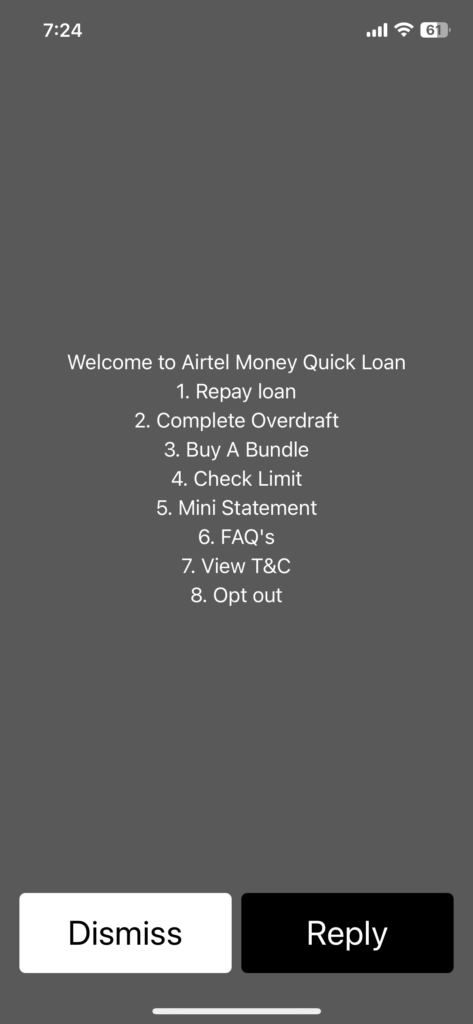

- Tẹ *185*8*2#

- Tẹ PIN Owo Airtel rẹ sii

- Yan Aṣayan 1: Awin Sanpada

- Yan boya lati sanwo ni apakan tabi iye kikun

- Iye naa yoo yọkuro lati iwọntunwọnsi Owo Alagbeka rẹ ati pe iwọ yoo gba ifiranṣẹ kan ti o sọ pe iye naa ti yọkuro pẹlu iwọntunwọnsi imudojuiwọn rẹ.

Awọn ẹya ati Awọn anfani ti Awọn awin Iyara Airtel

Airtel Quick Loans comes with some handy features. For example, you can take multiple loans as long as you stay within your credit limit. You can use this service to send money, pay merchants, cover bills, or buy data bundles and airtime.

Awin naa fun ọ ni irọrun, nitorinaa o ko ni lati ṣe aniyan nipa iwọntunwọnsi akọọlẹ rẹ nigbati o nilo lati ṣe isanwo iyara kan. Awọn iṣẹ awin iyara Uganda bii eyi n di pataki fun ọpọlọpọ eniyan.

Lilo Awọn awin Iyara Airtel

Using Airtel Quick Loans is straightforward. If you’re trying to send money but don’t have enough in your Airtel Money account, how to get quick loan on Airtel Money is simple.

Just dial *185# to start the transaction. If your balance is too low, the Airtel Quick Loan menu will pop up to let you borrow the money needed to complete the transaction.

Ilana kanna n ṣiṣẹ fun rira akoko afẹfẹ, sisanwo awọn owo, ati awọn iṣowo miiran. O jẹ ojutu iyara ati irọrun fun bii o ṣe le gba awin iyara ni Uganda.

Awọn idiyele, Awọn idiyele, ati Awọn ofin isanpada

Airtel Quick Loans come with some costs. There’s a 2% application fee, and they charge 1% interest on the amount you borrow every day for up to 15 days. For example, if you borrow 50,000 UGX, you’ll end up paying back 58,500 UGX if you take the full 15 days to repay.

Sibẹsibẹ, ti o ba san pada laipe, anfani yoo dinku, fifipamọ owo rẹ. Loye awọn idiyele jẹ apakan pataki ti bii o ṣe le gba awin iyara lori Airtel ni ifojusọna.

Ṣiṣakoso awin iyara Airtel rẹ

O le ni rọọrun ṣayẹwo opin awin rẹ ati ṣakoso awin rẹ nipa lilo akojọ aṣayan Awin Iyara Airtel. Bii o ṣe le gba awin iyara lori Owo Airtel ati ṣakoso rẹ rọrun bi titẹ *185*8*2# to access the menu.

To see how much you can borrow, select the option to check your limit. When it’s time to repay, choose the repayment option, enter the amount you want to pay, and follow the prompts.

O tun le ṣe awọn sisanwo apa kan ti o ko ba ni iye ni kikun. Ẹya yii jẹ ki awin iyara Uganda awọn iṣẹ rọrun ati ore-olumulo.

Awọn ifilelẹ ati Awọn ihamọ

Airtel Quick Loans have some limits to keep in mind.

- There are minimum and maximum amounts you can borrow, and the loan is mainly for completing specific transactions like sending money or paying bills.

- You can’t withdraw the loan as cash, and you need some balance in your Airtel Money account to access the loan.

Mọ bi o ṣe le gba awin iyara lori Airtel ati oye awọn opin wọnyi yoo ṣe iranlọwọ fun ọ lati lo iṣẹ naa ni imunadoko.

Ipari

Airtel Quick Loans is a helpful service for anyone who needs a little extra money to get through a financial pinch. It’s easy to use, has flexible terms, and can be a real lifesaver when your balance is low.

Ti o ba ro pe iṣẹ yii le wulo, ṣayẹwo ti o ba yẹ ki o forukọsilẹ loni lati rii bi o ṣe le gba awin ni iyara lori Airtel ati bẹrẹ anfani lati iṣẹ awin iyara Uganda.