Kumaha Kéngingkeun Pinjaman Gancang dina Airtel

Panungtungan diropéa dina 21 Agustus 2024 ku Michael WS

Tulisan ieu nyarioskeun kumaha carana kéngingkeun pinjaman gancang dina Airtel. Di Uganda, pinjaman gancang janten langkung populer, khususna ayeuna jalma-jalma pulih tina pandémik sareng peryogi artos gancang. Airtel Uganda gawé bareng sareng ngamimitian fintech anu disebut YABX pikeun ngenalkeun jasa anu disebut Airtel Quick Loans. Ladenan ieu dirarancang pikeun ngabantosan jalma-jalma ngalangkungan waktos finansial anu hese ku masihan aranjeunna aksés gancang kana artos nalika aranjeunna peryogi pisan.

Naon ari Pinjaman Gancang Airtel?

Airtel Quick Loans is a service offered by Airtel Uganda that lets you borrow money to complete transactions when you don’t have enough funds in your Airtel Money account.

Naha anjeun ngirim artos, mayar, atanapi mésér waktos siaran sareng bungkusan, Pinjaman Gancang Airtel tiasa ngabantosan anjeun ngaréngsékeun transaksi anjeun sanajan kasaimbangan anjeun rendah. Upami anjeun panginten kumaha kéngingkeun pinjaman gancang dina Airtel, jasa ieu ngajantenkeun saderhana.

BACA OGE: Biaya Airtel Duit

Kelayakan sareng Kumaha Ngadaptar

Henteu sadayana tiasa kéngingkeun Pinjaman Gancang Airtel, tapi upami anjeun layak, ngadaptarkeun gampang. Anjeun kedah gaduh dipaké Airtel Money salila genep bulan kalawan sahenteuna hiji transaksi unggal bulan sareng ngabersihkeun pinjaman Airtel Money sateuacana.

How to get a quick loan on Airtel starts with:

- Telepon *185*8*2# on your phone

- Lebetkeun PIN Airtel Money anjeun

After you sign up, Airtel Uganda will check if your number qualifies for the loan service. If you’re eligible, you’ll get a welcome message and can start using the service right away.

Upami henteu, tetep nganggo Airtel Money sapertos biasa sareng parios deui engké pikeun ningali naha anjeun cocog.

Kumaha Anggo Pinjaman Gancang Airtel

Saatos ngadaptar pikeun Pinjaman Gancang, anjeun tiasa ngamimitian nganggo ku nuturkeun léngkah ieu:

- Pencét *185# sareng nyobian transaksi, sapertos ngirim artos atanapi mayar tagihan.

- It doesn’t matter how much money is currently in your account.

- The amount you can borrow with Quick Loan can be higher.Try sending an amount that is more than your current balance.

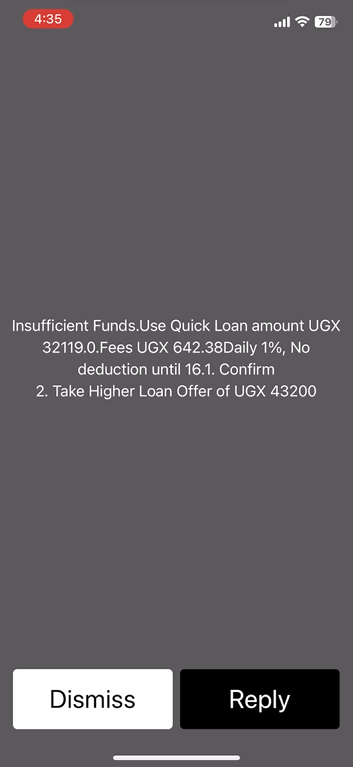

- For example, if you’re sending money to someone, enter an amount higher than what’s available in your account.The transaction will fail, and you’ll receive a prompt.

- A message will appear, offering to complete the transaction using Quick Loan.Dial the code provided in the message to borrow the amount needed.

- Pinjaman bakal dikreditkeun kana akun artos sélulér anjeun.Saatos injeuman dikredit, anjeun tiasa pariksa kasaimbangan anjeun, anu ayeuna bakal kalebet jumlah anu diinjeumkeun.

- Tungtungna, cobian deui urus, sareng éta bakal suksés salami jumlah urus cocog sareng kasaimbangan anu diropéa.

Kumaha Bayar Pinjaman Gancang Airtel

Mayar deui Pinjaman Gancang Airtel anjeun saderhana sareng lugas. Naha anjeun hoyong mayar sadayana sakaligus atanapi ngadamel pamayaran parsial, Airtel Uganda parantos ngajantenkeun prosésna gampang diturutan.

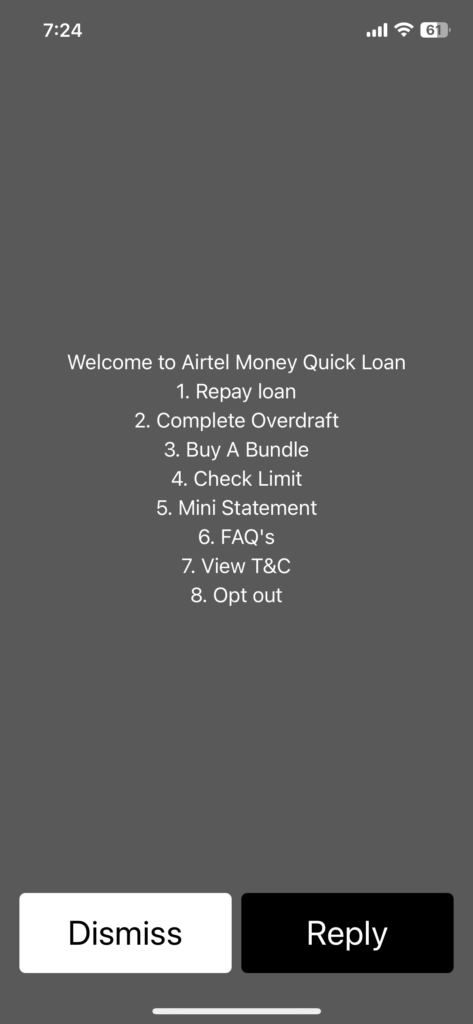

- Pencét *185*8*2#

- Lebetkeun Airtel Money Pin Anjeun

- Pilih Pilihan 1: Bayar Pinjaman

- Pilih boh mayar sawaréh atawa jumlah pinuh

- Jumlahna bakal dikurangan tina kasaimbangan Duit Mobile anjeun sareng anjeun bakal nampi pesen anu nyatakeun yén jumlahna parantos dipotong ku kasaimbangan anjeun anu diropéa.

Fitur sareng Kauntungan Pinjaman Gancang Airtel

Airtel Quick Loans comes with some handy features. For example, you can take multiple loans as long as you stay within your credit limit. You can use this service to send money, pay merchants, cover bills, or buy data bundles and airtime.

Pinjaman masihan anjeun kalenturan, ku kituna anjeun henteu kedah hariwang ngeunaan kasaimbangan akun anjeun nalika anjeun kedah mayar gancang. Pinjaman gancang jasa Uganda sapertos ieu janten penting pikeun seueur jalma.

Ngagunakeun Airtel Gancang injeuman

Using Airtel Quick Loans is straightforward. If you’re trying to send money but don’t have enough in your Airtel Money account, how to get quick loan on Airtel Money is simple.

Just dial *185# to start the transaction. If your balance is too low, the Airtel Quick Loan menu will pop up to let you borrow the money needed to complete the transaction.

Proses anu sami ieu tiasa dianggo pikeun ngagaleuh airtime, mayar tagihan, sareng transaksi anu sanés. Éta mangrupikeun solusi anu gancang sareng gampang pikeun kumaha kéngingkeun pinjaman gancang di Uganda.

Biaya, Biaya, sareng Sarat Pamayaran

Airtel Quick Loans come with some costs. There’s a 2% application fee, and they charge 1% interest on the amount you borrow every day for up to 15 days. For example, if you borrow 50,000 UGX, you’ll end up paying back 58,500 UGX if you take the full 15 days to repay.

Nanging, upami anjeun mayar langkung gancang, bungana bakal langkung handap, ngahémat artos anjeun. Ngartos biaya mangrupikeun bagian anu penting pikeun kéngingkeun pinjaman gancang dina Airtel kalayan tanggung jawab.

Ngatur Pinjaman Gancang Airtel Anjeun

Anjeun tiasa sacara gampil pariksa wates injeuman anjeun sareng ngatur injeuman anjeun nganggo ménu Pinjaman Gancang Airtel. Kumaha carana kéngingkeun pinjaman gancang dina Airtel Money sareng ngatur éta sagampil nelepon *185*8*2# to access the menu.

To see how much you can borrow, select the option to check your limit. When it’s time to repay, choose the repayment option, enter the amount you want to pay, and follow the prompts.

Anjeun oge bisa nyieun pangmayaran parsial lamun teu boga jumlah pinuh. Fitur ieu ngajantenkeun jasa pinjaman Uganda gancang sareng ramah-pamaké.

Watesan jeung Watesan

Airtel Quick Loans have some limits to keep in mind.

- There are minimum and maximum amounts you can borrow, and the loan is mainly for completing specific transactions like sending money or paying bills.

- You can’t withdraw the loan as cash, and you need some balance in your Airtel Money account to access the loan.

Nyaho kumaha carana kéngingkeun pinjaman gancang dina Airtel sareng ngartos watesan ieu bakal ngabantosan anjeun ngagunakeun jasa éta sacara efektif.

kacindekan

Airtel Quick Loans is a helpful service for anyone who needs a little extra money to get through a financial pinch. It’s easy to use, has flexible terms, and can be a real lifesaver when your balance is low.

Upami anjeun nganggap jasa ieu tiasa mangpaat, pariksa naha anjeun layak sareng ngadaptarkeun dinten ayeuna pikeun ningali kumaha kéngingkeun pinjaman gancang dina Airtel sareng mimitian nyandak kauntungan tina jasa pinjaman Uganda gancang ieu.