Unlock Your Financial Future with MTN Yinvesta: A Simple Guide

Last Updated on June 12, 2025 by Micheal W S

Are you looking for a simple way to grow your money? MTN Yinvesta could be the solution you need. This guide will help you understand how it works and address any questions you might have. Let’s explore the benefits together.

What is MTN Yinvesta?

MTN Yinvesta is a service that lets you invest your money easily using your MTN Mobile Money account. It partners with Sanlam Investments East Africa Limited. They are experienced fund managers licensed in Uganda. Your money is invested in the Sanlam Income Fund. This fund pools money from many investors. It then buys different financial assets. Think of it as a way to make your money work for you. Mobile money investment offers a convenient way to participate in financial growth directly from your phone.

Understanding the Basics

Opting In: You agree to the terms when you select “Opt in.” This confirms you’ve read and understood everything. You commit to using the platform responsibly and legally.

Key Definitions:

- Agreement: These terms and conditions can be updated by MTN.

- Applicable Law: The laws of Uganda govern this agreement.

- Calendar Day: All days of the week, including holidays.

- Opt Out: When you decide to close your Yinvesta account.

- Customer: You, the MTN Mobile Money user with a Yinvesta account.

- Data Protection Law: Laws protecting your personal information in Uganda.

- Equipment: Your phone or tablet used to access Yinvesta.

- Fees: Currently, depositing and withdrawing from Yinvesta has no extra charges.

- MTN Platform: The MoMo platform you use to access Yinvesta.

- MTN Yinvesta: Your investment account with Sanlam through MTN.

- Initial Deposit: You can start with as little as UGX 1,000.

- Interest: The return on your investment, calculated daily. It ranges from 10% to 12% per year.

- Personal Information: Your details used to identify you and meet regulations.

- Auto-Savings: Automatically scheduled transfers from your MTN account to Yinvesta. You can set the frequency.

- Request: Instructions you send through the MoMo platform.

- Sanlam Income Fund: The investment fund managed by Sanlam.

- Services: Investment in Yinvesta, auto-saves, statements, withdrawals, rate inquiries, and calculators.

- Withdrawal Request: Your instruction to move funds from Yinvesta to your MoMo wallet.

Getting Started with MTN Yinvesta

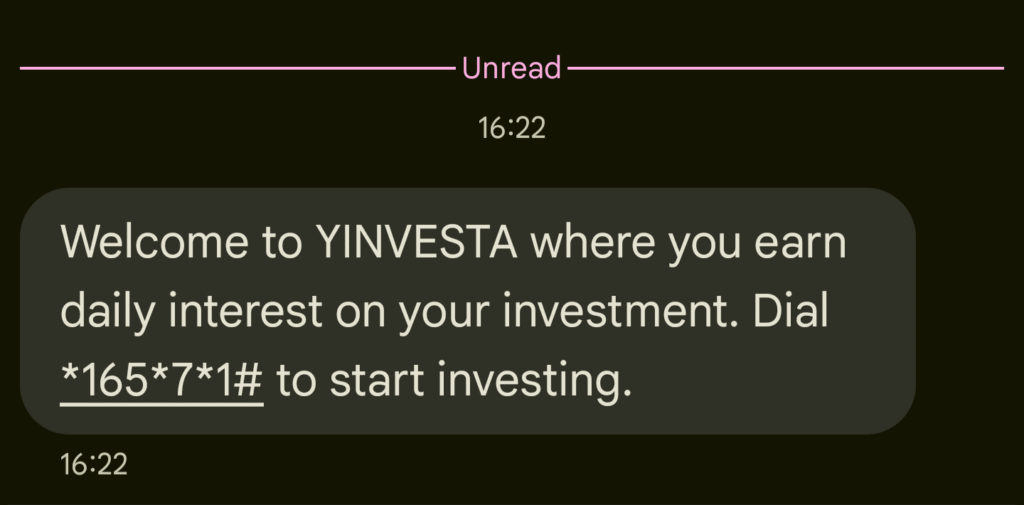

Accessing MTN Yinvesta is straightforward. Simply dial *165*7*1# on your phone. Then, enter your MoMo PIN. Select option 1 for Yinvesta. You will see a link to the Terms and Conditions. After accepting them, you are successfully registered! Remember to keep your MoMo PIN safe. Your PIN is key to accessing your Yinvesta account.

Your Investment: The Sanlam Income Fund

MTN Yinvesta gives you access to the Sanlam Income Fund. This fund operates like a collective investment. Your money is combined with others to invest in various financial assets. The Capital Markets Authority of Uganda regulates this fund. The returns come mainly from earned interest. However, gains or losses from the fund’s holdings can also affect it. Keep in mind that past performance does not guarantee future results. The value of your investment can go up or down. You take on the investment risks when you put money into this fund. It’s wise to learn about the Sanlam Income Fund’s details and risks.

Who Can Join MTN Yinvesta?

To use MTN Yinvesta, you need to meet a few simple requirements. First, you must have an active MTN Mobile number. You also need to be at least eighteen (18) years old. Ensure you are not on any list of prohibited or restricted individuals. You must provide accurate information during registration. Importantly, you should read and understand these Terms and Conditions. By opening a Yinvesta account, you confirm you meet these criteria. You also agree not to use the services for any illegal activities. MTN has the right to refuse or revoke your account access if needed.

Agreeing to the Terms

Before using Yinvesta, carefully read and understand the Terms and Conditions. This includes any updates from MTN. When you click “Opt in” on the MoMo platform, you agree to be bound by these terms. This means you’ve read, understood, and accepted them. If you disagree, select “Decline,” but you won’t be able to use the services. Your continued use of Yinvesta after any changes means you accept the updated terms. MTN will try to inform you of any changes via the platform, SMS, or email. Understanding these terms helps ensure a smooth experience.

Managing Your Money: Deposits and Withdrawals

Depositing money into your Yinvesta account is easy after you “Opt in.” You can transfer funds directly from your MTN MoMo wallet. When you need to access your funds, you can submit a Withdrawal Request. You can withdraw a part or all of your Yinvesta balance. This includes your initial investment and any interest earned. You can also choose to “Opt Out,” which closes your account and withdraws all funds. Remember, you cannot withdraw more than what is available in your Yinvesta account. MTN will confirm your Withdrawal or Closure Request via SMS and a platform notification. Once you enter your PIN, your MoMo wallet and Yinvesta balances will be adjusted. Any delays in processing withdrawals will be communicated to you by MTN. MTN is not responsible for delays in processing deposits or withdrawals.

Opting Out When You Need To

You can choose to end this agreement at any time. Simply use the “Opt Out” option in Yinvesta or close your MTN Wallet. MTN also has the right to suspend or close your Yinvesta account. This can happen if there’s suspicion of fraudulent or illegal activity. This ensures the safety and security of the platform for all users.

Earning Interest on Your Savings

The interest you earn with Yinvesta is calculated daily. This interest can be withdrawn at the end of each month. You can view your daily interest earned in your Yinvesta account. Upon request, MTN will also provide a monthly report showing your daily interest earnings. The advertised interest rate is an annual rate. It already reflects any fee deductions. This transparent approach helps you see your money grow. Saving and investing early allows your money to grow over time through the power of compounding.

Your Responsibilities as a Customer

As a Yinvesta user, you must keep your Mobile Money PIN confidential. MTN is not liable for any losses if your PIN is stolen or compromised. You are responsible for all transactions made through your Yinvesta account. This includes deposits and withdrawals. Always ensure your PIN is secure and never share it with anyone. Protecting your PIN is crucial for your financial security.

Making Requests and Giving Instructions

When you send a request through the MoMo platform, you authorize MTN to act on it. You are responsible for all requests that come from your account. MTN has the right to reject any request at their discretion. They may also refuse deposits or withdrawals that seem suspicious or unusual. If your request is rejected, MTN will inform you and explain the next steps. MTN is considered to have acted correctly even if a request was made by mistake or fraudulently. You are still responsible for requests processed in good faith. MTN may delay acting on a request until they get more confirmation from you. If there’s a conflict between your request and this agreement, the agreement’s terms will prevail. You agree to protect MTN from any claims or losses related to their actions based on your requests.

Understanding the Fees Involved

The Sanlam Income Fund charges an Annual Management Fee of 1.5% of your invested amount. This fee is deducted before interest is paid to you. It will not appear as a transaction on the MTN USSD platform. MTN MoMo may also charge a service fee of 1% on the interest you earn. This will be deducted from your overall return. Understanding these fees helps you know the actual returns on your investment.

Indemnification: Protecting MTN

You agree to protect and hold MTN harmless from any losses or claims related to your use of Yinvesta. This includes issues arising from the unavailability of necessary hardware or software. It also covers losses due to misuse of third-party software or your failure to follow this agreement or provide correct information. Additionally, it includes losses from the failure of third-party systems. This section outlines your responsibility in protecting MTN from potential liabilities.

Limitations of Liability: What MTN is Not Responsible For

MTN is not responsible for any issues related to the knowledge or use of your MTN Account PIN. They are also not liable for any losses, damages, or injuries resulting from your access to or use of the MTN platform. This includes any information on the platform or your personal information transmitted through it. Specifically, MTN is not liable for: issues caused by your changes to the MTN platform, lack of funds in your account, legal restrictions on your funds, incorrect withdrawal instructions, illegal activities conducted through your account, or your failure to follow this agreement.

Protecting Your Data

MTN understands the importance of your personal information. By using their services, you agree to the processing of your data according to their Privacy Policy. This policy follows all applicable data privacy laws in Uganda. It’s your responsibility to read and understand the Privacy Policy available on the MTN website. MTN will keep your personal information confidential and use security measures to protect it as described in the Privacy Policy. The Privacy Policy explains what data is collected, how it’s processed, who it’s shared with, your rights, and contact details for complaints.

More on Limitation of Liability

You agree to fully protect MTN against any claims, losses, damages, costs, or expenses arising from the misuse of your Yinvesta Account. If MTN cannot debit your account due to closure or other reasons beyond their control, your instructions will not be honored. You acknowledge that Yinvesta services depend on the availability of third-party networks and platforms. MTN is not liable if they cannot provide the service due to reasons beyond their control, such as strikes, power failures, or issues with third-party services. If MTN doesn’t enforce any part of this agreement immediately, it doesn’t mean they can’t enforce it later. MTN is not responsible if an authorization request is declined because your account has been terminated or suspended. MTN is also not liable for withdrawals you authorize using your PIN.

Changes to These Terms

MTN may change these terms and conditions over time. They will give you 30 days’ notice of any changes via SMS, their website, or other means. Changes that benefit you may not require prior notice. Your continued use of Yinvesta after these changes take effect means you accept the new terms.

Compliance with Laws and Reporting

As part of the MTN Group, MTN must follow international and local laws, including those related to sanctions and anti-money laundering. To comply with these obligations and fight fraud, MTN will screen and monitor all Yinvesta users and transactions. This may lead to delays, limitations, or even suspension of accounts or transactions. MTN will try to inform you of any such actions. You agree that neither MTN nor its employees will be liable for any losses caused by these measures. You also agree to use your Yinvesta account lawfully and comply with all applicable laws, including anti-corruption laws. You consent to MTN sharing your transaction data with relevant third parties, including regulatory authorities, for legitimate inquiries or investigations. You also authorize MTN to process your personal data and transfer it outside Uganda for the purposes of this agreement and as allowed by law. You acknowledge that if your account is found to contain proceeds of criminal activity, MTN may be legally required to surrender the funds. MTN may keep your transaction data for up to ten years after this agreement ends or as required by law.

General Information and Legal Matters

These terms and conditions, along with MTN’s relevant policies, form the complete agreement between you and MTN. Each part of these terms is considered separate. If any part is found to be unenforceable, the rest of the agreement will still be valid. You cannot transfer your rights or obligations under this agreement to someone else without MTN’s written consent. MTN can transfer its rights and obligations by giving you notice. However, not providing notice will not affect the validity of the transfer. MTN can update these terms and conditions from time to time, and the latest version will be on their website. The laws of Uganda govern your use of Yinvesta. Any disputes will be handled by the courts in Uganda. MTN has the right to suspend or change the eligibility for any services at any time. They can also suspend or terminate accounts used for illegal or fraudulent activities.

Your Privacy is Important

By using Yinvesta, you agree to MTN using your personal information and data as described in their Privacy Notice. You can find the Privacy Notice at MTN Uganda Privacy Policy. It explains how your information is collected, used, shared, and protected.

Intellectual Property Rights

The MTN platform, Yinvesta, logos, and related intellectual property belong to MTN or their partners. Similarly, the names, logos, and intellectual property of Sanlam Investments East Africa Limited belong to them. Any new intellectual property created through the partnership will be jointly owned unless developed independently. You are not allowed to use any of this intellectual property without prior written permission from MTN.

Benefits of MTN Yinvesta

- Accessibility and Convenience:

- Low Barrier to Entry: You can start investing with as little as UGX 1,000. This makes it highly accessible to a broad range of Ugandans, including those with limited disposable income.

- Mobile-First: The service operates entirely through your MTN MoMo wallet. This eliminates the need for physical bank visits or complex paperwork. It is incredibly convenient for daily use.

- Ease of Use: Simple USSD codes (

*165*7*1#) make managing your investment straightforward. - Flexible Deposits: You can add funds to your investment at any time, allowing for consistent savings.

- Auto-Savings Feature: The option for automatic transfers helps build a saving habit effortlessly.

- Potential for Growth:

- Competitive Interest Rates: Yinvesta offers an interest rate of 10% to 12% per annum. This is generally higher than traditional savings accounts in commercial banks.

- Daily Interest Calculation: Interest is calculated daily and paid out monthly, allowing for compounding benefits over time.

- Professional Management: Your funds are managed by Sanlam Investments East Africa Limited, a licensed fund manager. This provides professional oversight of your investment.

- Liquidity:

- Easy Withdrawals: You can withdraw your funds back to your MoMo wallet at any time. This provides good liquidity, making your money accessible when needed.

- Financial Inclusion:

- For many Ugandans, especially in rural areas, mobile money services like Yinvesta offer a crucial gateway to formal financial services. This contributes to broader financial inclusion.

Potential Downsides and Risks

- Investment Risk:

- Market Fluctuations: While the Sanlam Income Fund aims for stable returns, it’s a unit trust. The terms explicitly state, “Past performance is not an indicator of future performance as price of units may rise or fall.” You bear the investment risk, meaning your invested capital is not guaranteed.

- Suspension of Redemptions: In certain circumstances, your right to withdraw funds might be suspended. This is a standard disclaimer for unit trust funds but important to note.

- Fees:

- Annual Management Fee: Sanlam Income Fund charges a 1.5% annual management fee on your invested amount. This is deducted before interest is paid.

- MTN MoMo Service Fee: MTN MoMo may charge a 1% service fee on the interest accrued. This reduces your net return.

- While deposits and withdrawals to/from your MoMo wallet have no direct Yinvesta fees, standard MoMo transaction fees for cash-in/cash-out might still apply depending on how you fund your MoMo wallet or access the cash.

- Digital Security:

- PIN Confidentiality: You are solely responsible for protecting your MoMo PIN. MTN is not liable for losses due to compromised PINs. While convenient, mobile platforms carry digital security risks if not handled carefully.

- Reliance on Third Parties:

- The service relies on the functionality of MTN’s network and Sanlam’s fund management. While regulated, any disruptions to these services could impact your access or transactions.

Is it Worth It? A Conclusion

MTN Yinvesta appears to be a good option for:

- Beginner Investors: The low entry point and ease of use make it excellent for those new to investing.

- Individuals Seeking Higher Returns than Traditional Savings: The 10-12% annual interest rate is attractive compared to typical bank savings accounts.

- Convenience Seekers: If you primarily use mobile money and value quick, seamless transactions from your phone.

- Building a Savings Habit: The auto-savings feature is a powerful tool for consistent wealth building.

- Short to Medium-Term Goals: Its liquidity makes it suitable for funds you might need within a few years, offering better returns than just keeping cash idle.

However, it might require caution for:

- Highly Risk-Averse Individuals: While considered low-risk for an investment fund, it’s not a fixed deposit; there’s always a possibility of capital loss.

- Large-Scale Investors: For very large sums, exploring a broader range of investment products with a financial advisor might be more appropriate.

- Those Uncomfortable with Digital Transactions: While secure with proper PIN management, the entirely digital nature might not suit everyone.

Overall, MTN Yinvesta presents a valuable opportunity for financial growth and inclusion in Uganda. Its accessibility and competitive interest rates make it a compelling choice for many. However, understanding the fees and acknowledging the inherent investment risks, though low for this type of fund, is crucial. If you are comfortable with the digital platform and the explained risks, Yinvesta can be a worthwhile addition to your financial planning.